Are you putting yourself, your assets and belongings, or maybe even your pet at risk? Our new report reveals you might be.

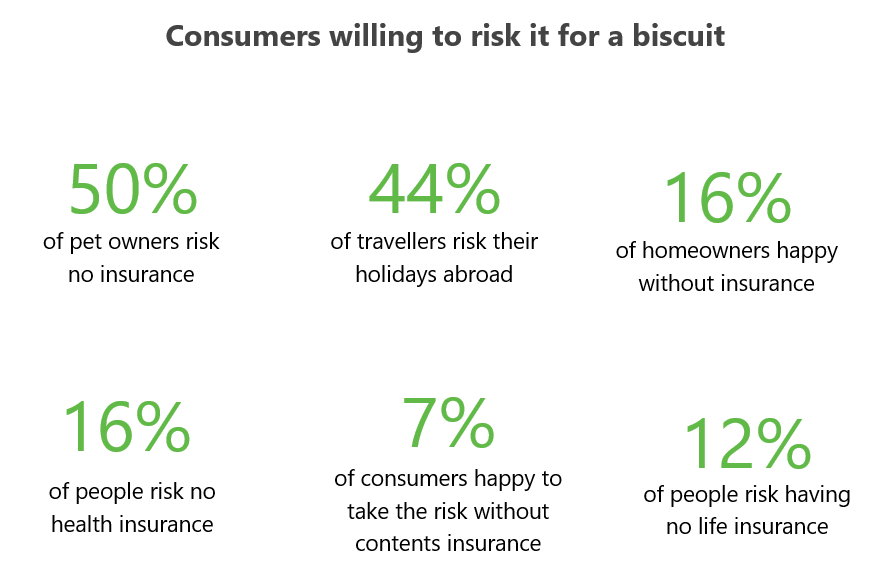

There’s a 16% gap between the number of us who need insurance and those who have it. Almost half of people without insurance don’t have contents insurance, despite the average home containing £34,725 worth of items.

Nearly a third of people are putting their cash – and their precious pooches – at risk by not having pet insurance. But perhaps the riskiest of all, two in 25 of us who own a home are not covered by buildings insurance.

It’s our British boldness that is seemingly creating the gap as a quarter of people admit to being happy to take their chances without insurance.

But if something were to go wrong, you could face a huge expense you may not be able to afford.

Instead of risking it for a biscuit, follow our top tips to buying and understanding insurance.

- Get the right cover. Before you start looking at prices, and so you’re not tempted by the cheapest policy, compare insurances by what they cover – making sure they cover the things you need.

- Read the terms. Don’t buy a policy without fully understanding the terms and conditions. If you haven’t read them, you could find out you’re not covered for certain situations. Remember you have a 14-day cooling-down period after buying most insurance policies, so use that time to familiarise yourself with the t’s and c’s.

- Compare costs. Once you know which covers will work best for your needs, use a comparison tool to check which providers are offering the best deals.

- Check cashback. Once you’ve picked a provider and a particular policy, check TopCashback.co.uk as you can earn up to £700 on policies from life insurance to pet insurance, to see if you can earn cashback. The site offers cashback on everything from travel to contents, buildings and life insurance.

- Don’t lie. Although it may be tempting to tell a little white lie on the application form to reduce the cost, you could end up in big trouble when your policy is cancelled, or a claim is rejected in the future.