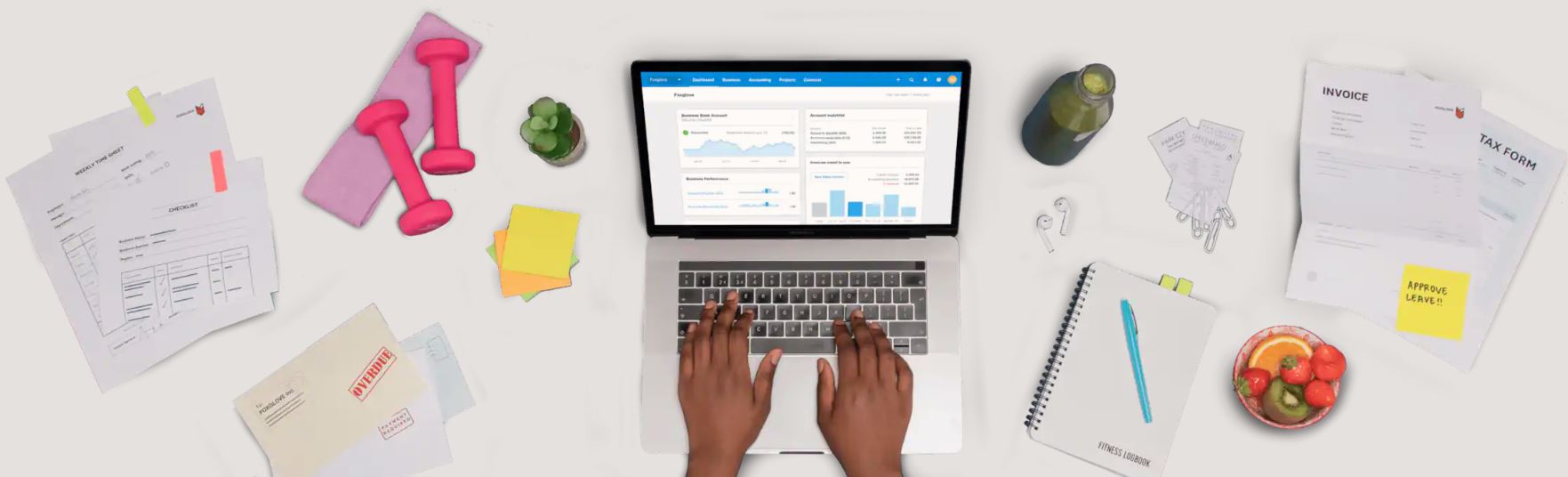

Xero is world-leading online accounting software built for small business. How will Xero improve business operations? Well, Xero helps you plan for the future, giving you a view of your business finances anywhere. Healthy business starts from £12 per month and you can pick a plan to suit your business needs on the Xero website.

It offers real-time financial data, is simple to use and you can have unlimited users. It’s accounts and payroll all in one. Xero online accounting software for small businesses connects you to your bank account, accountant, bookkeeper and other business apps. Is Xero accounting free? No, but business owners can sign up for a 30-day free trial, start using the Xero accounting platform for free and make sure your business is ready for Making Tax Digital.

After your trial, you can decide which of the Xero subscription plans best suits your business. There are three Xero for small business subscription packages — Starter, Standard and Premium plans — to which each you can choose optional add-ons like Xero Pay with Wise, Payroll and Xero Expenses. Founded in 2006, Xero software has more than three million subscribers, including accounting firms worldwide, and is a leader in cloud-based accounting across New Zealand, Australia and the United Kingdom.

Xero UK online accounting software can make running your business easier. It will automate many day-to-day tasks and keep you up to date on the money side of your business. Xero software will allow you to collaborate easily, automate manual tasks and access client records any time with tools to manage your practice. It also connects with more than 1,000 third-party apps for an integrated, streamlined business solution. If you need any help, you can contact Xero support too.

Which Features Does Xero Offer?

Why Xero accounting software? Well, basically, you can run your United Kingdom business using Xero accounting software. What is Xero accounting? Well, let’s look at some of its main features. Firstly, you can track and pay your bills on time, and get a clear overview of accounts payable and cash flow. Access your bills online from anywhere, make batch payments and schedule them in advance.

When it comes to VAT returns, Xero can help you submit them online. It calculates VAT and files VAT returns online securely with HMRC, using software which is compatible with HMRC systems. VAT is worked out and included in returns, while you can view VAT transaction details and adjust. Does Xero do expenses? Yes, you can track and manage expense claims with it. Use Xero expense manager on the go to capture costs to submit and reimburse expense claims, plus view spending — all with expense manager tools.

Make expense claims fast and paperless by taking a photo of receipts. Reimburse expenses properly and approve claims without delay, while you can view analytics to manage expenses or claim them right away using the mobile app. Connect your bank to Xero meanwhile and set up bank feeds so your transactions flow straight into Xero each business day. This will allow you to keep track of money coming in and going out, while you’ll benefit from a secure and reliable bank connection.

Xero will allow you to accept online payments easily and get paid up to twice as fast by connecting to Stripe, GoCardless and others. Add a ‘pay now’ button to your online invoices and safely accept credit card payments and direct debits. Xero will also allow you to track projects, pay employees with HMRC-recognised online payroll software and reconcile bank transactions quickly. So, if you're wondering 'can Xero make payroll payments', it certainly can.